THE MISNOMER OF "NOT-FOR-PROFIT" HOSPITALS

A CLOSER LOOK AT TAX AVOIDANCE AND COMMUNITY BENEFIT

The term "not-for-profit hospital" conjures images of charitable institutions prioritizing patient care over financial gain. But this label masks a more complex reality.

These organizations might be more accurately described as "non-tax-paying hospitals" - entities that leverage community benefit claims to avoid taxation while operating with business models indistinguishable from their for-profit counterparts.

As a former healthcare CEO who has navigated both the business and policy sides of healthcare, I've witnessed how the not-for-profit designation often functions more as a tax strategy than a reflection of operational philosophy.

The distinction between for-profit and not-for-profit hospitals has blurred significantly, with the latter enjoying substantial tax advantages while sometimes delivering questionable community returns.

The financial implications are staggering.

Not-for-profit hospitals avoid paying property taxes to local municipalities, income taxes to federal and state governments, and often sales taxes on purchases. This tax exemption represents billions in foregone public revenue annually - money that could fund schools, infrastructure, and public health initiatives in the communities these hospitals serve.

And all of it is done under the umbrella of community benefit.

THE TAX EXEMPTION PARADOX

Not-for-profit hospitals receive tax exemptions based on the premise that they provide charity care and other community benefits that offset the lost tax revenue.

This arrangement dates back to the early 20th century when hospitals were primarily charitable institutions caring for the indigent. Today's reality is dramatically different.

You've seen the church affiliations or evangelical-sounding names.

Modern not-for-profit hospitals operate sophisticated business enterprises with complex financial structures, investment portfolios, and executive compensation packages that rival corporate America.

The American Hospital Association reports that not-for-profit hospitals represent about 58% of all U.S. hospitals, controlling trillions in assets while avoiding an estimated $24.6 billion in federal, state, and local taxes annually. More recent estimates show this figure has increased to approximately to $28 billion in 2020 and $37.4 billion in 2021.

The Committee for a Responsible Federal Budget estimates that the federal tax advantages will cost the government over $280B in revenue over a decade.

The property tax exemption alone is particularly impactful for local communities.

A hospital system occupying prime real estate in a metropolitan area might avoid tens of millions in annual property taxes - revenue that would otherwise support local schools, police, fire departments, and infrastructure.

How much is it costing your community? The real answer is we really don't know.

I had a member of the Texas Legislature once remark that "local appraisal districts don't even look anymore at the value of a hospital. Why would they? It doesn't matter."

Meanwhile, these same institutions often maintain substantial financial reserves.

It's not uncommon for large not-for-profit hospital systems to hold billions in investment portfolios and offshore accounts, all while maintaining their tax-exempt status.

Billions that is all tax exempt. Let that sink in.

Especially when we think about health care costs.

THE COMMUNITY BENEFIT SHELL GAME

The IRS requires not-for-profit hospitals to provide "community benefit" to justify their tax exemption. However, this standard is notoriously vague and inconsistently applied.

Hospitals have significant latitude in what they count as community benefit and how they calculate its value.

Many hospitals count "underpayments" from Medicare and Medicaid as community benefit, effectively claiming government reimbursement shortfalls as charitable activity. Others include medical education costs, research expenses, and even marketing activities promoting "community health."

The actual charity care - free or discounted services for patients unable to pay - often represents a small fraction of claimed community benefit. A 2021 study in JAMA Network Open found that charity care accounted for just 1.4% of operating expenses at the average not-for-profit hospital.

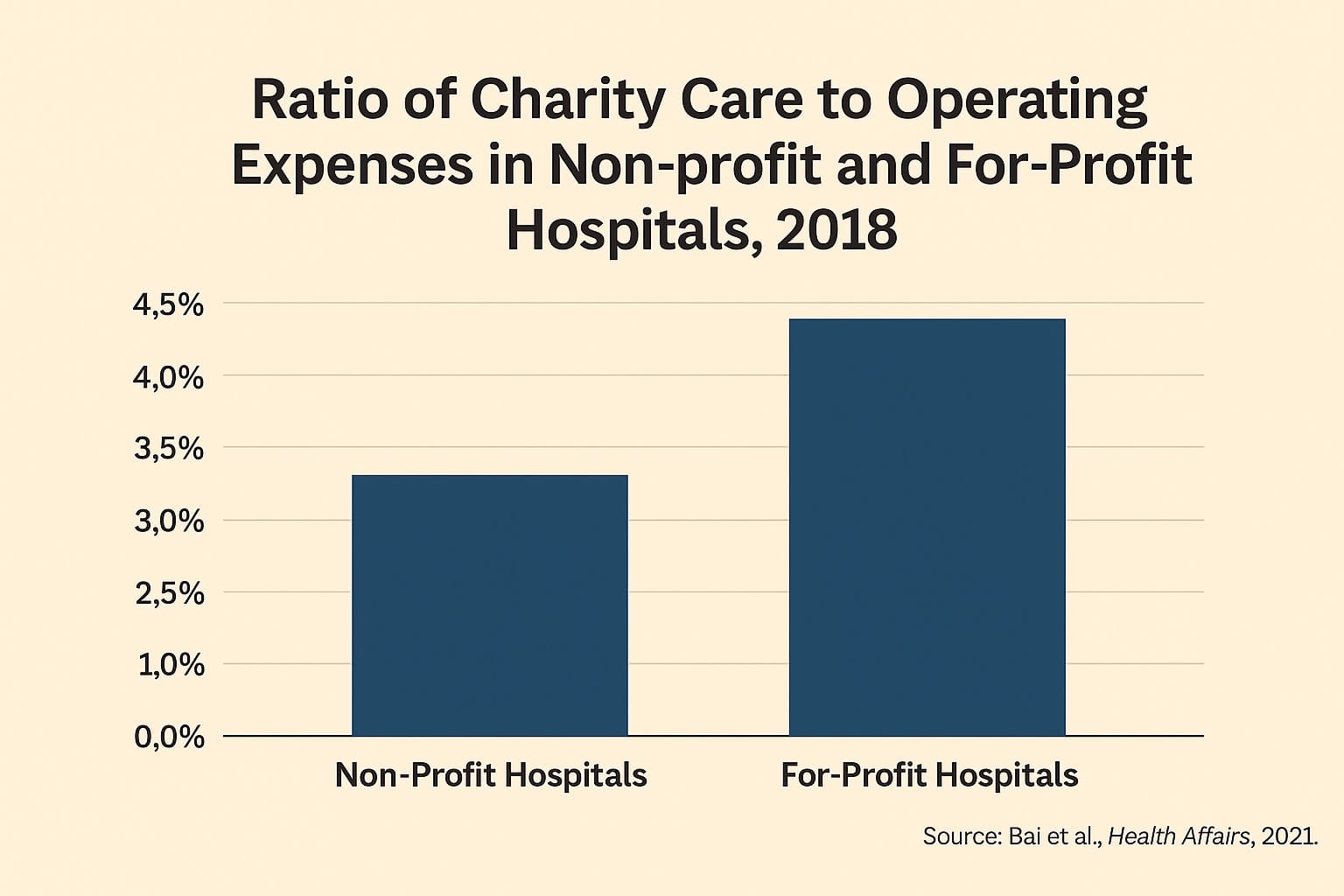

Additionally, recent studies have found that nonprofit hospitals generally provide less charity care than their for-profit counterparts.

The community benefit reporting system also allows hospitals to report charges rather than costs when calculating charity care, artificially inflating the value of services provided.

A $10,000 procedure with an actual cost of $3,000 might be reported as $10,000 in community benefit, even though the hospital only foregoes $3,000 in potential revenue.

This accounting sleight-of-hand creates a situation where hospitals claim substantial community benefit while providing minimal actual charity care. The result is a tax exemption that often exceeds the value of community services provided.

THE FOUNDATION FUNDRAISING PARADOX

Perhaps most perplexing is how not-for-profit hospitals leverage their community benefit narrative to raise additional funds through hospital foundations.

These foundations solicit donations from community members who have already "donated" through foregone tax revenue.

Hospital foundations raise billions annually, often for capital projects that increase the hospital's market value and competitive position rather than expanding charity care.

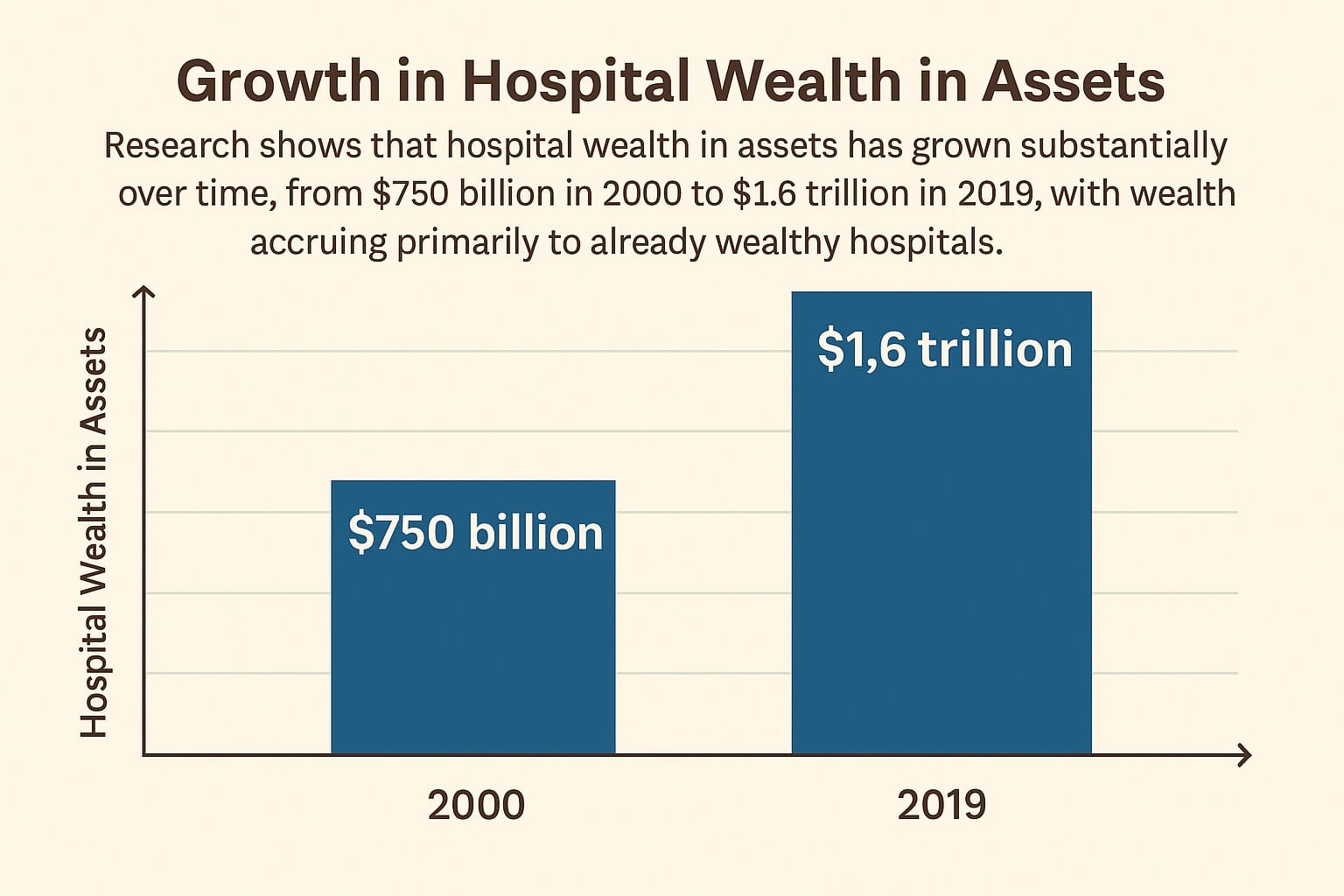

Research shows that hospital wealth in assets has grown substantially over time, from $750 billion in 2000 to $1.6 trillion in 2019, with wealth accruing primarily to already wealthy hospitals.

New wings, advanced technology, and specialty centers may enhance the hospital's prestige and revenue potential, but they don't necessarily improve access for underserved populations.

This creates a double subsidy - communities forego tax revenue and then donate additional funds to the same institutions.

The foundations themselves enjoy tax-exempt status, creating another layer of tax avoidance.

The fundraising appeals often emphasize the hospital's charitable mission and community service, creating a perception of financial need that contradicts the reality of billion-dollar investment portfolios and executive compensation packages that frequently exceed $1M to 5M annually.

THE COST PARADOX

Despite their tax advantages and ostensible not-for-profit mission, these hospitals often charge higher prices than their for-profit counterparts.

A 2021 RAND Corporation study found that not-for-profit hospitals charged privately insured patients an average of 247% of Medicare rates, compared to 209% at for-profit hospitals.

This pricing disparity contradicts the notion that not-for-profit status leads to more affordable care.

Instead, these hospitals often use their market position and reputation to command premium prices, contributing to healthcare inflation that affects all consumers.

The higher costs aren't explained by quality differences.

Research consistently shows no systematic quality advantage for not-for-profit hospitals. A 2020 study in Health Affairs found no significant difference in mortality rates, readmissions, or patient satisfaction between not-for-profit and for-profit hospitals after adjusting for patient characteristics.

This cost paradox raises fundamental questions about the value proposition of tax exemption.

If not-for-profit hospitals don't provide more charity care, don't charge lower prices, and don't deliver better outcomes, what justifies their preferential tax treatment?

EXECUTIVE COMPENSATION AND CORPORATE BEHAVIOR

Not-for-profit hospitals frequently pay their executives compensation packages that rival or exceed for-profit counterparts.

CEO compensation at major not-for-profit health systems routinely exceeds $2 million annually, with some packages reaching $5 million or more.

I once had a venture capital investor tell me he could determine if a hospital was for-profit or n0t-for-profit just by looking at the size and decor in the CEO‘s office.

Posh finishes, leather furniture, and wood paneling indicated a not-for-profit CEO’s office. The for-profit counterparts were housed in something looking like it belonged on a military base.

These compensation levels are difficult to reconcile with charitable missions and tax-exempt status.

While the IRS requires "reasonable compensation," the standard is loosely applied, with hospitals justifying high salaries through compensation consultants and market comparisons.

Beyond executive pay, not-for-profit hospitals often exhibit corporate behaviors indistinguishable from for-profit entities.

They pursue aggressive growth strategies, engage in mergers and acquisitions to increase market share, and sometimes employ aggressive collection practices against patients unable to pay.

Some not-for-profit hospitals have faced criticism for suing thousands of patients, garnishing wages, and placing liens on homes - actions seemingly at odds with charitable missions.

THE PATH FORWARD: REDEFINING THE SOCIAL CONTRACT

The current system of hospital tax exemption needs fundamental reform to align incentives with public benefit. Several approaches could improve accountability and ensure communities receive value for foregone tax revenue:

1. Standardize and strengthen community benefit requirements, with minimum thresholds for actual charity care as a percentage of revenue or expenses.

2. Implement payment-in-lieu-of-taxes (PILOT) programs where hospitals contribute a negotiated amount to local governments, recognizing the value of municipal services they receive.

3. Tie tax exemption to pricing transparency and affordability, requiring not-for-profit hospitals to maintain prices within a reasonable percentage of Medicare rates.

4. Establish executive compensation limits for tax-exempt hospitals, perhaps tied to a multiple of median employee compensation.

5. Create independent non-hospital-appointed oversight boards with community representation to evaluate whether hospitals are fulfilling their charitable missions.

6. Require regular community health needs assessments with measurable implementation plans and accountability for outcomes.

CONCLUSION

The label "not-for-profit hospital" has become increasingly misleading in today's healthcare landscape.

These institutions operate sophisticated businesses with complex financial structures while avoiding billions in taxes through a loosely defined community benefit standard.

A more accurate description might indeed be "non-tax-paying hospitals" - organizations that leverage tax exemptions while often delivering community benefits of questionable value.

The social contract underlying these exemptions needs renegotiation to ensure public resources are used effectively.

This isn't to suggest that all not-for-profit hospitals fail their communities.

Many provide valuable services and genuine charity care. However, the system lacks accountability and transparency, allowing some institutions to exploit tax advantages without providing commensurate public benefit.

As healthcare costs continue to rise and communities struggle with limited resources, we must reconsider whether the current tax exemption model serves the public interest.

The goal should be a system where tax benefits are earned through demonstrable community service rather than granted through historical precedent and accounting maneuvers.

The time has come to hold these institutions accountable to their charitable missions or acknowledge them for what many have become - tax-advantaged businesses in the competitive healthcare marketplace.

Member discussion